Did You Know the U.S. has Fined Transunion and Equifax Over $23 Million For Deceiving Customers About the Cost of Credit Scores

Check your bank accounts, you may have some money headed your way soon. On Tuesday, United States regulators fined Transunion and Equifax over $23.5 million in fines and restitution for deceiving customers who purchased credit score information. If you have ever purchased your credit score, you may have noticed that they may inform you that the fee to receive your score will cost you $6.00, however once you process your infomation on their website, you may have ended up with a $20-$30 charge, or some sort of monthly fee for their services. In some cases, many consumers thought they were purchasing their credit scores for $1.00, but ended up with a yearly service costing them $200 or more.

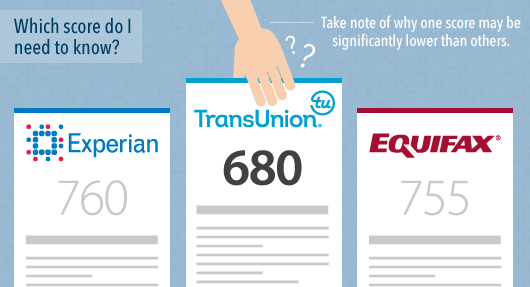

Transunion has to return almost $14 million to consumers and pay over $3 million in fines. Equifax must pay customers $3.8 million in restitution and pay $2.5 in fines, and so far Experian has not been fined. After an investigation by the U.S. Consumer Protection Financial Bureau, they discovered this bait-and-switch type tactic had been going on from July 2011 until March 2014.

To resolve any future issues, both companies are now required to change their marketing practices, which include:

- Getting a customer’s consent before enrolling them in additional services

- Getting consent for services where fees kick-in after a free-trial period

- Making it easier for consumers to cancel services they do not want

TransUnion representative David Blumberg and Equifax spokeswoman Ines Gutzmer stand with their companies and issued this statement: “their respective companies believe they have complied with applicable laws, and are committed to better educating consumers about their credit.”

Neither company has admitted or denied any wrongdoing.

Syllabus Magazine, the Carolina’s source for Music, Culture and Fashion