It’s the end of the year and its that time again. Charleston County intends on auctioning HUNDREDS of pieces of property of residents who are delinquent on their property taxes. Yes, this sounds mean, however if you are a Charleston native, then you know this is just one of the ways black families, who have had property in their families for decades, no longer are the owners of their properties.

Historically, there have been many generations of blacks who have acquired land, but unfortunately due to lack of knowledge or available funds, generations of descendants have not been able to hold on to this land. The property, in some cases is now worth millions because of the increase in values here in the Lowcountry – and some of this property was purchased for just pennies on the dollar. Many were acquired through county tax sales.

The solution. If you can’t beat them – join them! Charleston has a growing network of young investors who are slowly acquiring property around the Lowcountry. This is a good thing, not only is it a great business investment, but it is one of the main tools of building wealth that can last for generations. And let’s be honest, if young, black investors don’t get into the land acquisition game – then rich, white developers will simply continue to buy everything!

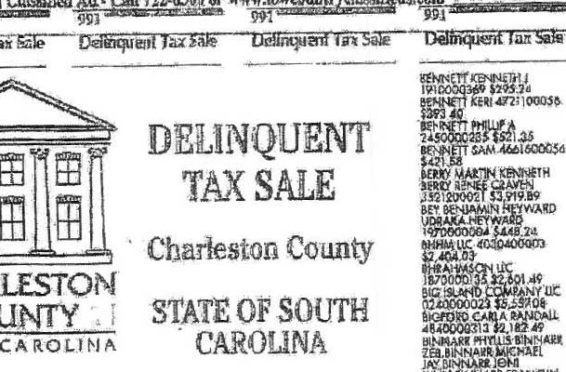

On December 11th, from 9am – 5pm Charleston county will hold its annual delinquent tax sale auction. If this is your first time considering bidding on property, here are a few things you should know.

There is a long, comprehensive list of property addresses available on charlestoncounty.org. Here, you will find all property within the county that currently has delinquent taxes. Click Here to download the Real Property Listing and Click Here to download the Mobile Home Tax Sale ListingNote: If you see any names on this listing of people or family member that you know – contact them immediately. Many times, this property is heirs property, and family members have no idea the land they own is set to be auctioned off! This is why families lose their property every year.

If you attend the auction, remember the auction will be held ALL DAY, with no lunch breaks – so get comfortable!

The property listed on the website is at risk of being auctioned, but owners still have until December 9th to pay any taxes, so the list could change by December. They will also publish properties for sale in the Post and Courier on December 6th. This published list is also not the list that will be used on the day of the auction.

For $10, you can register as a bidder for the Charleston County Tax Sale. This registration will help to avoid lines on the day of the tax sale, provide you a bidder card, and updated listing on the day of the sale. Bring a valid photo I.D.

All bids are to be paid with cash, money order or certified check by the end of the business day. If you do not pay by the end of the day, you will be charged $500 and court fees.

You cannot bid on your own property. You cannot have someone bid on your behalf on your own property.

If you win a bid, you cannot redeem the property for 12 months. The original owner is still allowed to pay the money in order to retain their property. If this happens, the bidder will be reimbursed the amount of the bid + interest. See the detailed interest rates on charlestoncounty.org

Syllabus Magazine, the Carolina’s source for Music, Culture and Fashion