10 Surprising Things To Know About Americans & Saving Money

With this President in office along with the recent changes to the Tax Scam Plan that give benefits to the wealthy, while punishing the poor, many can already tell there’s something muddy in the waters. There are many financial gurus advising that American should take this time to sow, save, and take advantage of any plans where its possible to build wealth. With this President and this administration, the future seems unpredictable.

Unfortunately, America is an Instagram influenced culture. Too many people trying to look rich and too many people not thinking long-term when it comes to savings. Here are 10 interesting things to know about Americans and their savings:

1. 50% of Americans have $0 put away for retirement

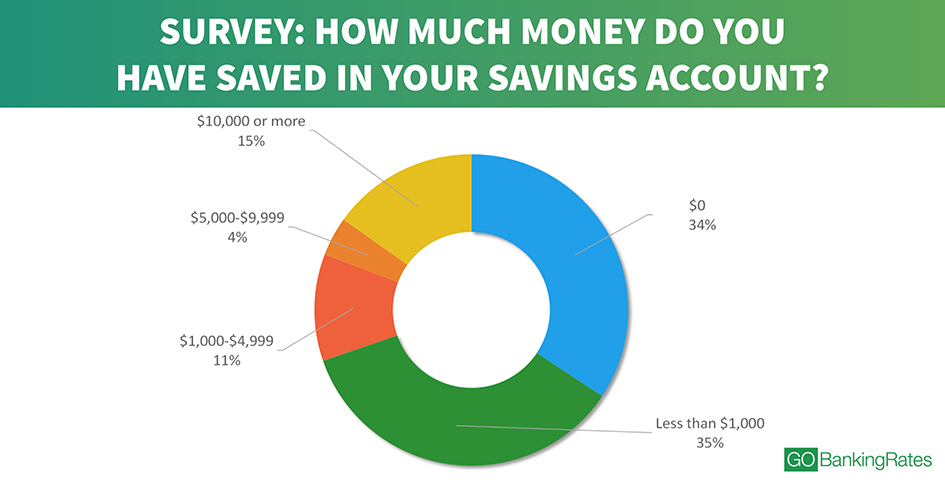

2. 35% of All Adults have less than Several Hundred Dollars in a savings account

3. Only 15% of Americans have over $10,000 stashed away

4. American’s biggest financial mistake is not saving early enough for retirement

5. Experts claim the following is what we should have saved by age:

20 years old: 25% of your overall gross pay

30 years old: Save the equivalent of your annual salary

35 years old: 2 Times your annual salary should be saved

40 years old: 3 Times your annual salary should be saved

45 years old: 4 times your annual salary should be saved

50 years old: 5 times your annual salary should be saved

6. Suze Orman thinks it is ridiculous to have a 3-6 month emergency fund because it takes many people much longer to find a new job if they get laid off. Orman suggests having 8-12 months of living expenses saved in an emergency fund.

How to save more money: Ask for a raise, get a side hustle, start a home business and set daily savings goals – even if its just $5 a day

7. There was an article on CNN titled, “11 Signs You Will Be A Millionaire”, a few of those signs:

Having specific goals for your money, Having multiple streams of income, Being Decisive, and Thinking Big

8. Economists claim that families are starting to spend more now that the economy is better, but they are still not saving. It’s called The Wealth Effect

“the low savings rate may be a sign that Americans are simply feeling good about their financial lives. As a rule, families tend to spend more when stock prices and home values are rising, since they feel richer. “

9. According to NerdWallet.com, the average American owes:

$15,654 in Credit Card Debt (Total $905 Billion)

$173,995 in Mortgage Debt (Total $8.74 Trillion)

$27,669 in Car Debt (Total $1.21 Trillion)

$46,697 in Student Loan Debt (Total $1.36 Trillion)

$131,000 in Various Other Debt (Total $12.96 Trillion)

10. Most Americans believe they do not earn enough money. Over 60 % of Americans surveyed believe, to feel comfortable, they would need an additional $6,000 per year

Source: The Slate ,CNBC,Nerd Wallet,NewsWeek

Syllabus Magazine, the Carolina’s source for Music, Culture and Fashion